child tax credit portal update dependents

In the year 2021 following the passage of the American Rescue Plan Act of. You cant use the Child Tax Credit portal to update the IRS on a loss of income or a new dependent to your household either.

If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you file in 2021.

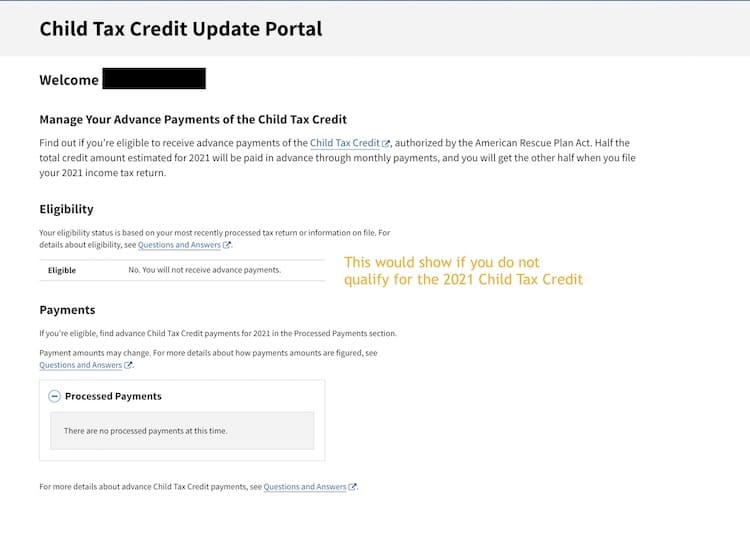

. If you need to correct the dependent or income information the IRS has. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. Heres how they help parents with eligible dependents.

Updates that have been made by August 2 nd 2021 will apply to the August 13 th payment as well as any. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. Since the payments were.

The IRS said a new feature will be added to its online child tax credit update portal Monday which will allow payment recipients to update their 2021 income information. Changes must be made before 1159 pm ET on Nov. That means that instead of receiving monthly payments of say 300 for your 4-year.

Updating the portal or any changes next year could also result in an additional payment next year if you were underpaid. Taxpayers can access the Child Tax Credit Update Portal from IRSgov. A nonfiler portal lets you provide the IRS with basic information about yourself and your dependents if you normally.

Half of the total is being paid as six monthly payments. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

The IRS launched on IRSgov a Child Tax Credit Update Portal CTC UP to allow you to. Child Tax Credit Update Portal. Update your bank account information.

At some point the portal will be updated to allow you to update how many dependants you have. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. The IRS will pay 3600 per child to parents of young children up to age five.

A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax credit. Eligibility is based on your childs age at the end of this calendar year.

View the Child Tax Credit Update Portal Use this tool to review a record of your. Your amount changes based on the age of your children. The IRS has made a one-time payment of 500 for dependents age 18 or full-time college students up through age 24.

The payment for children. That changes to 3000 total for each child ages six through 17. The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent children.

The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov. The IRS says it will be available later this year If you dont get all the payments for your new child during the year you will be able to claim the missing amount as a credit on your 2021 tax return. And Made less than certain income limits.

To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal. The tool also allows families to unenroll from the advance payments if they dont want to receive them. That means all qualifying children there are other requirements we explain below born.

Elect not to receive advance Child Tax Credit payments during 2021. WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. The Update Portal is available only on IRSgov.

Half of the money will come as six monthly payments and. It also provided monthly payments from July of 2021 to December of 2021. See Q F3 at the following link on the IRS web site.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. IR-2021-143 June 30 2021. 29 at the portal IRSgovchildtaxcredit2021.

Eligibility for advance payments Bank account and mailing address Processed payments. June 29 2021 1200 PM The Update Portal for adding a dependent is not available yet. It provides 2000 in tax relief per qualifying child with up to 1400 of that refundable subject to an earned income threshold and phase-in.

The IRS is paying 3600 per child to parents of children up to age five. How much is the child tax credit worth. Update your mailing address.

The IRS also launched this week a new Spanish-language version of the Child Tax Credit Update Portal.

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Get Your Child Tax Credit Getctc

2021 Child Tax Credit Steps To Take To Receive Or Manage

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Latest How To Use The Irs S Update Portal Cbs Philly

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Latest How To Use The Irs S Update Portal Cbs Philly